|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Second Mortgage with Bad Credit: A Comprehensive GuideRefinancing a second mortgage can be a strategic move to improve your financial situation, even with bad credit. This guide explores how you can achieve this and what to consider during the process. Understanding Second MortgagesA second mortgage is a loan taken out on a property that already has a mortgage. It's essential to understand how they work to make informed refinancing decisions. Types of Second Mortgages

Each type has its pros and cons, which can impact your refinancing decision. Challenges of Bad CreditBad credit can complicate refinancing, but it doesn't make it impossible. Lenders are cautious with borrowers who have a low credit score, yet there are options available. Improving Your Credit Score

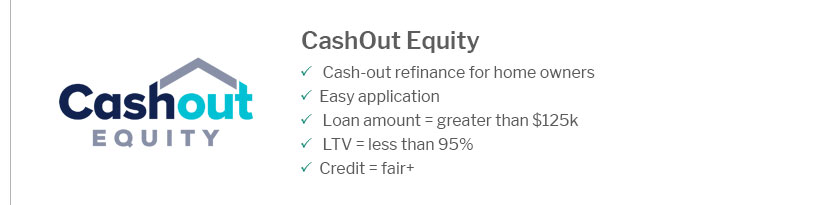

Even small improvements can significantly impact your refinancing options. Steps to Refinance a Second MortgageRefinancing involves several key steps that you should be familiar with. Evaluate Your Financial SituationAnalyze your current financial status, including your credit score, income, and outstanding debts. This evaluation helps determine if refinancing is a viable option. Research LendersNot all lenders offer the same terms. Compare different home refinance companies to find one that suits your needs, particularly those that cater to bad credit borrowers. Apply for RefinancingPrepare the necessary documentation and submit your application. Be honest about your financial situation to improve your chances of approval. Benefits of RefinancingRefinancing a second mortgage can provide several advantages, even with bad credit.

FAQCan I refinance a second mortgage with bad credit?Yes, it is possible to refinance a second mortgage with bad credit, though it may require additional documentation or a higher interest rate. What are the risks of refinancing with bad credit?Refinancing with bad credit may lead to higher interest rates and fees, making it crucial to thoroughly assess if the benefits outweigh the costs. How can I find a lender willing to refinance my second mortgage?Research and compare different lenders, focusing on those specializing in bad credit refinancing. Consulting a mortgage broker may also be helpful. https://www.bankrate.com/home-equity/home-equity-loan-bad-credit/

Yes, you can. A lower credit score doesn't necessarily mean a lender will deny you a home equity loan. Some home equity lenders allow for FICO ... https://www.refiguide.org/benefits-of-second-mortgage-loans/

When seeking approval for a bad credit 2nd mortgage, in most cases, lenders will consider applicants with a FICO score of 620 or higher. If you ... https://smartasset.com/retirement/home-equity-loan-with-bad-credit

However, those with lower credit scores can still qualify for second mortgages with low debt-to-income ratios and at least 15% equity in their ...

|

|---|